Personal Allowance 2024 25 – Use precise geolocation data and actively scan device characteristics for identification. This is done to store and access information on a device and to provide personalised ads and content, ad and . £15,000 salary If you earn a salary of £15,000 in 2024-25 and have no other income, the personal allowance of £12,570 will be deducted and £2,430 will be taxable. If you are resident in .

Personal Allowance 2024 25

Source : www.bbc.co.ukHow To Calculate Personal Tax Allowance in the UK for 2024/25?

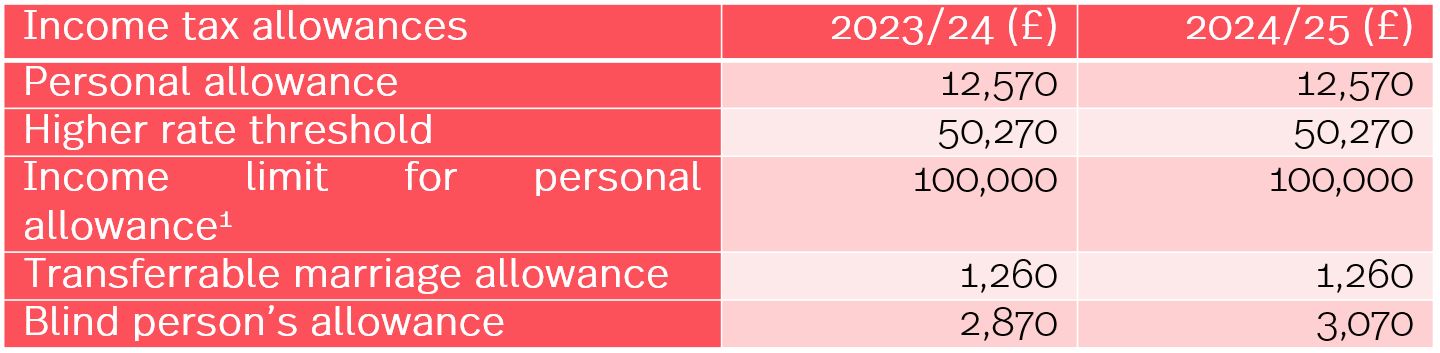

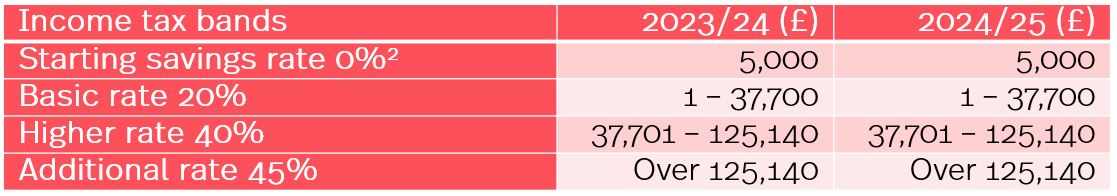

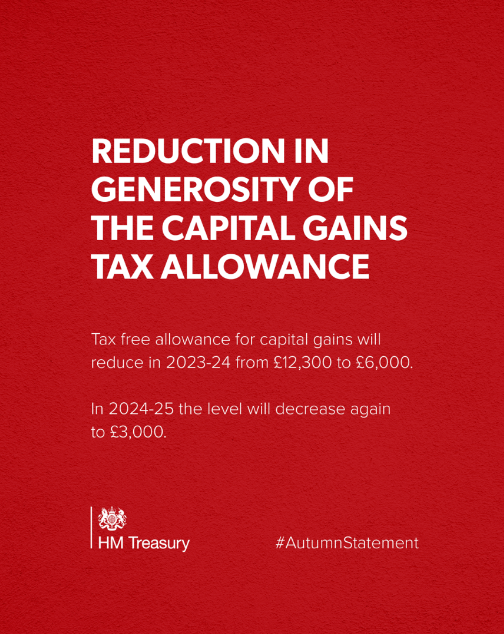

Source : nsfaslogin.co.zaAutumn Statement 2023 HMRC tax rates and allowances for 2024/25

Source : www.simmons-simmons.comHow To Calculate Personal Tax Allowance in the UK for 2024/25?

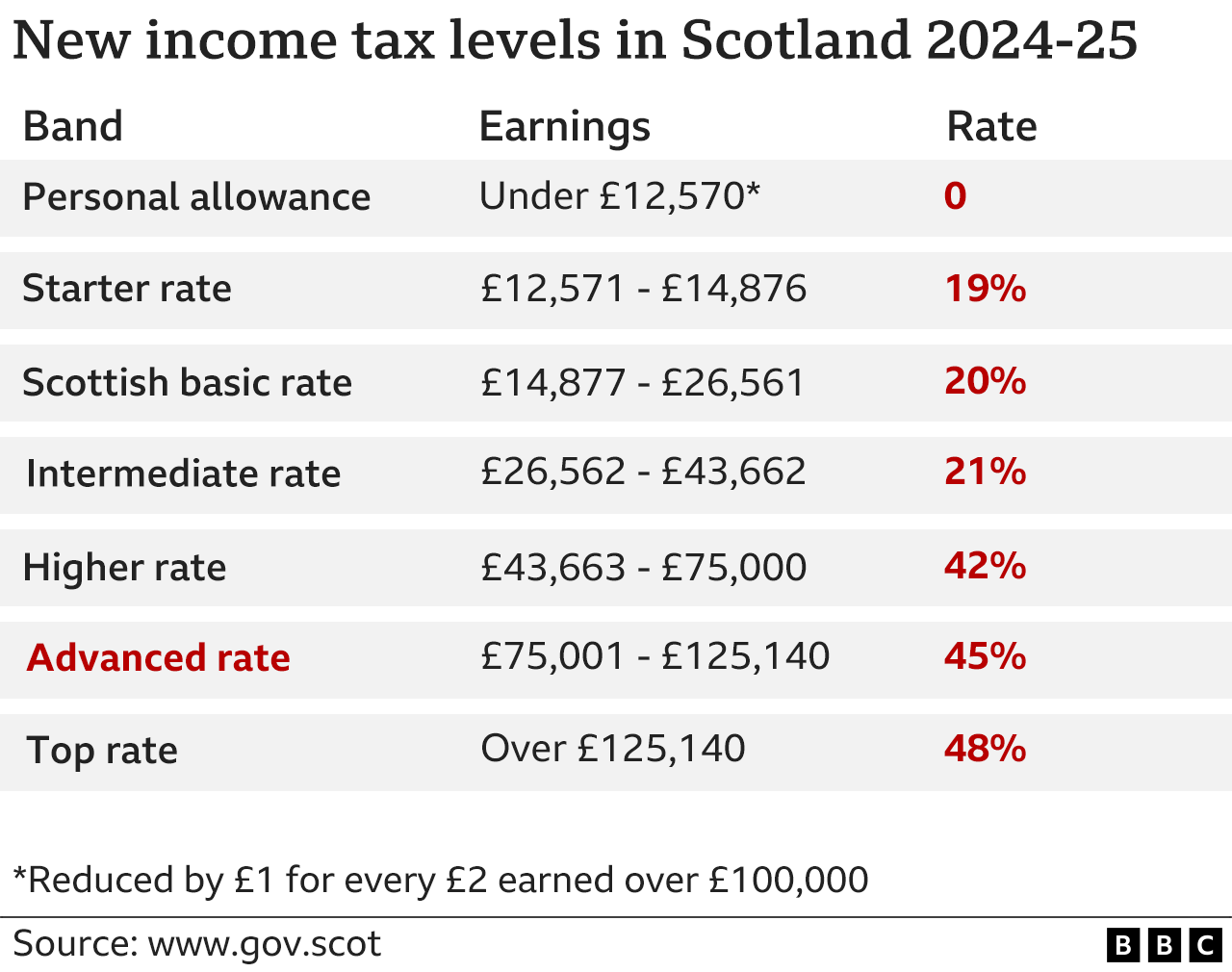

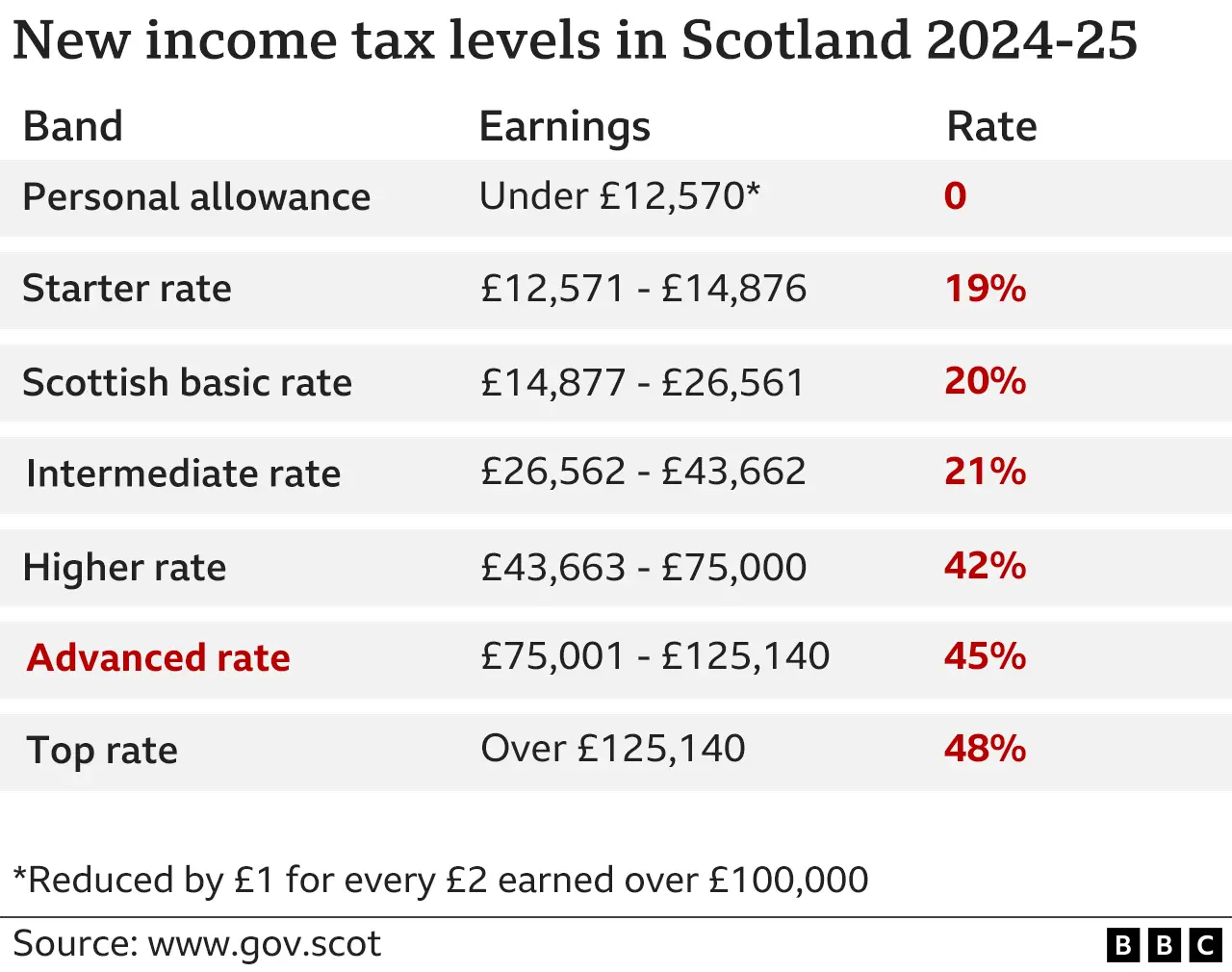

Source : nsfaslogin.co.zaScottish Budget: Higher earners to pay more income tax

Source : ca.news.yahoo.comScottish Budget: Higher earners to pay more income tax

Source : www.bbc.comAutumn Statement 2023 HMRC tax rates and allowances for 2024/25

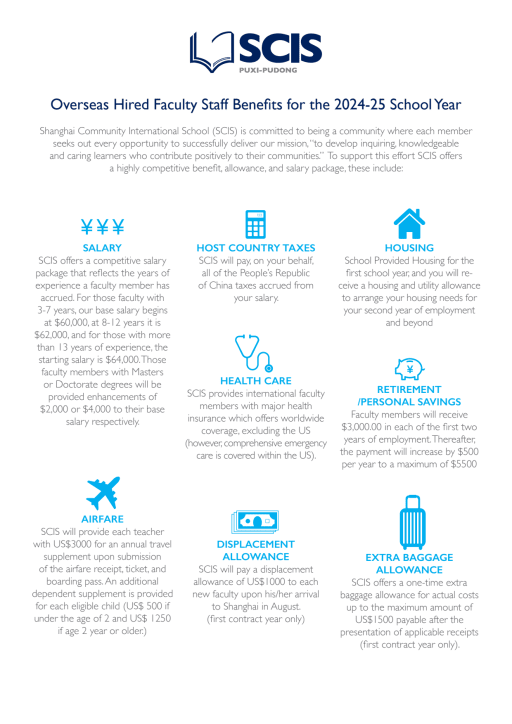

Source : www.simmons-simmons.comCompensation and Benefits | Shanghai Community International School

Source : www.scis-china.orgPersonal Tax Allowance 2024/25 What is it and How Much is Personal

Source : www.incometaxgujarat.orgHM Treasury on X: “To restore public finances and make the tax

Source : twitter.comPersonal Allowance 2024 25 Scottish income tax 2024 25 What might you be paying? BBC News: An estimated 900,000 people in receipt of the State Pension may need to pay tax for the 2024/25 financial year. . A new online petition is urging the UK Government to increase the personal tax allowance to £15,000 to “help people on a low wage” to offset the ongoing cost of living crisis. Chancellor Jeremy Hunt .

]]>